How much does errors and omissions insurance cost?

The average premium for errors and omissions insurance (E&O, also called professional liability insurance) is about $60 per month. Your exact cost will depend on several factors, including your industry and policy limits.

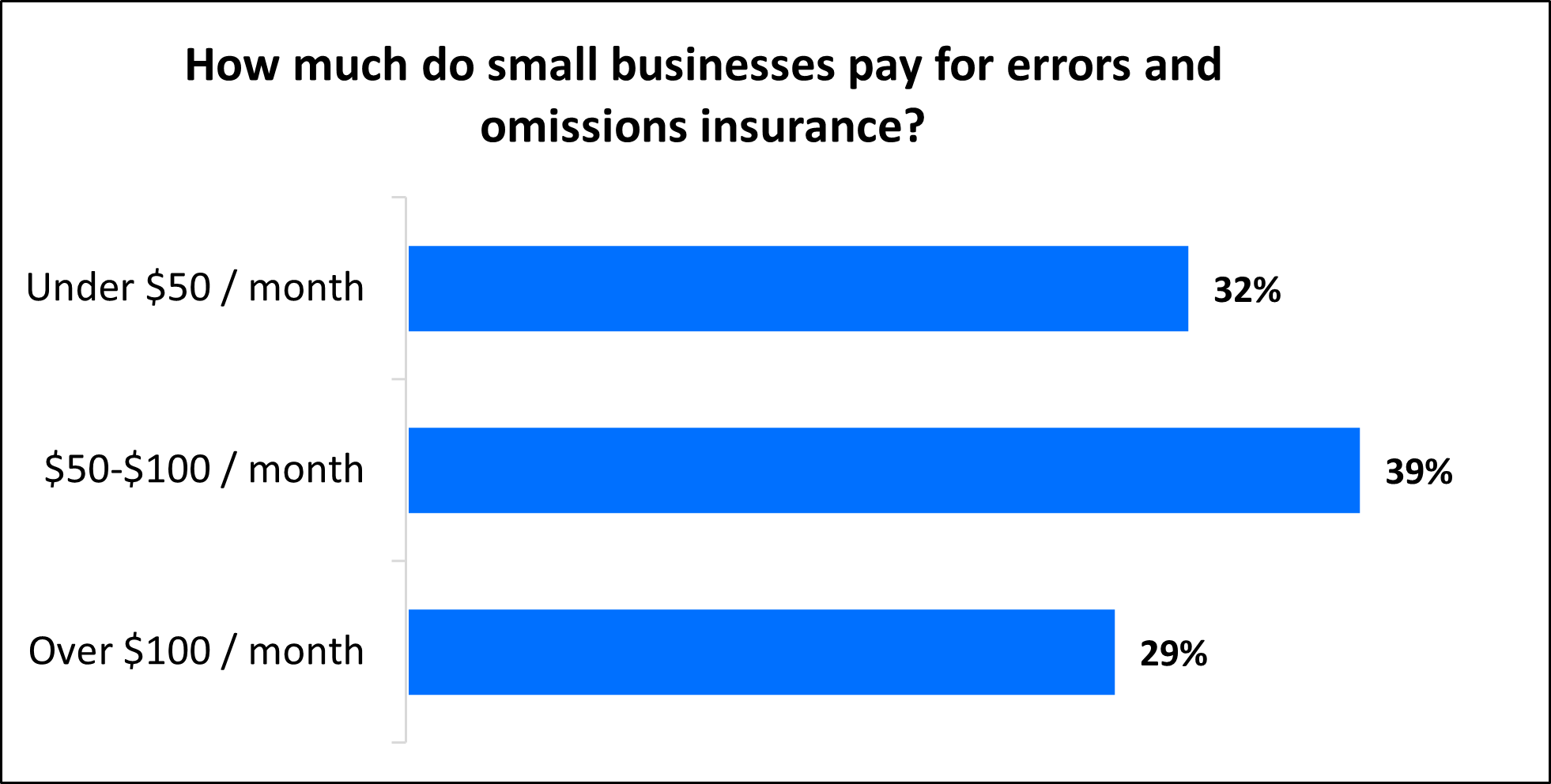

What do small businesses pay for errors and omissions insurance?

On average, errors and omissions insurance costs $61 per month, or about $735 annually. Most policyholders can expect to pay between $50 and $100 per month for their errors and omissions insurance coverage.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

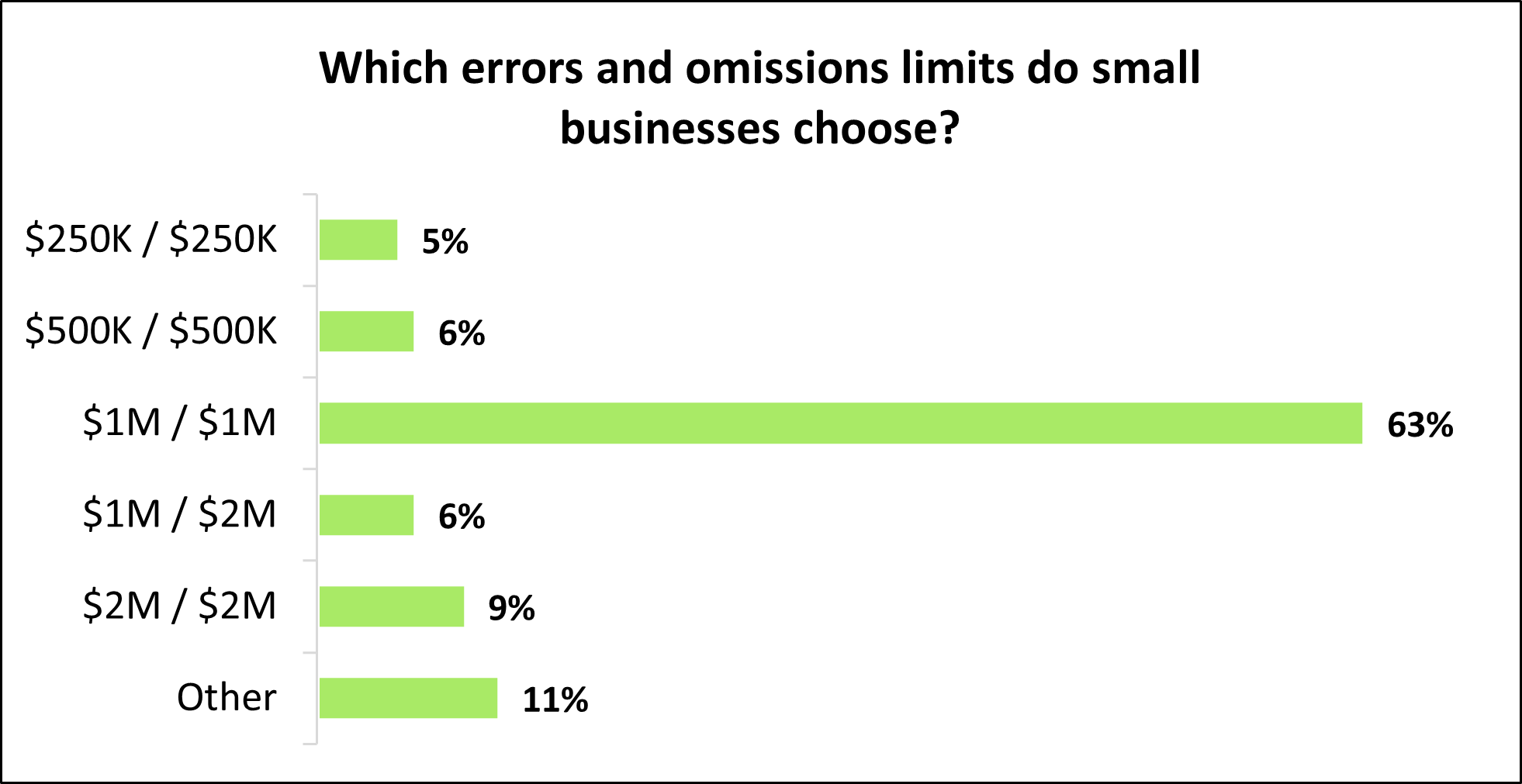

Policy limits determine the cost of E&O insurance

The cost you pay for errors and omissions insurance (also known as professional liability insurance or malpractice insurance) depends on your coverage limits. Most small business owners (63%) opt for an E&O policy with a $1 million per-occurrence limit and a $1 million aggregate limit.

E&O liability coverage helps pay for client lawsuits over quality of work, such as missed deadlines, work mistakes or errors, and accusations of negligence. This includes legal fees like attorney's fees.

Businesses that offer professional services or advice that affects a client's income should consider higher policy limits as they’re more susceptible to client lawsuits. Higher limits cost more, but they cover more expensive claims.

Other factors that affect E&O insurance costs

Your business type and its size will influence the cost of your errors and omissions coverage.

Your insurance provider will also look at:

Whether clients can blame you for financial loss

If your mistake costs a client money, you may have a lawsuit on your hands.

IT consultants, project managers, software developers, and others whose work directly impacts a client’s bottom line are at a higher risk of E&O lawsuits. This means they’ll likely pay more for their insurance policy.

For example, suppose a software developer is working on a program for a real estate company, but misses a bug. When the bug surfaces and crashes the client’s system for three days, the client could sue to recover lost profits and other costs.

Consultants and others who provide expert advice face similar risks. If your recommendations don’t produce the desired results, you could also be taken to court.

Your cyber risks

E&O insurance by itself won't protect you if a client sues over a cyberattack that results in a data breach. However, it's often bundled with cyber liability insurance in a package called technology errors and omissions insurance.

Tech E&O coverage costs depend on the amount of data and the number of employees who can access it. It’s simple math: more people accessing more data increases the chance of a data breach.

For example, large cybersecurity companies and businesses with sensitive digital assets would pay more for their tech E&O policy than a smaller technology company with fewer employees.

Your policy’s deductible

Policies with high deductibles cost less, but you’ll have to pay that amount before you can collect on a claim. Most TechInsurance customers choose a deductible of $2,500 for errors and omissions insurance.

Your claims history

Insurance companies look at your claims history to determine how risky you are to insure. Companies that have made past errors and omissions claims will pay more for insurance than those with a clean history.

Number of employees

It's simple: The more employees you have, the more opportunities there are for a client to file a lawsuit.

While errors and omissions insurance is recommended for many small businesses, most state laws require small business owners to carry workers' compensation if they have employees, and commercial auto insurance if they have business-owned vehicles.

If you are a freelancer, independent contractor or sole proprietor, it's still a good idea to carry E&O coverage to protect yourself from the high costs associated with defense costs.

How can you save money on E&O insurance?

It’s easy to save money on your omissions insurance policy without compromising on coverage.

Some strategies to keep costs down include:

- Bundle policies. Some small businesses may be eligible to bundle cyber liability insurance with E&O insurance in a technology errors and omissions policy. Generally, this policy costs less than purchasing the coverages separately.

- Pay the annual premium. When you buy a policy, you can choose to pay your premium monthly or annually. The annual amount costs less than paying by the month.

- Keep continuous coverage. Because errors and omissions insurance is a claims-made policy, you can also pay more to extend coverage to a date in the past. But it’s cheaper to maintain continuous coverage than to stop and restart a policy.

- Choose a higher deductible. Choosing a higher deductible is an easy way to save on your premium, but make sure to choose a deductible you can easily afford. If you can’t pay it, you can’t collect on a claim.

- Manage your risks. It’s unfortunate, but true: Claims on your insurance make your premium go up. You should reduce all type of risks to avoid claims and keep your premium low.

How can you avoid making claims on your errors and omissions policy?

A good risk management strategy to reduce E&O claims includes:

- Detailed contracts with clients

- Clear client communication

- Prompt resolution of complaints

- Checking (and double-checking!) your work for errors

- Strong cybersecurity measures to reduce cyber risks

You can’t eliminate risk. If that were possible, insurance companies would be out of business. But risk management helps you sidestep common pitfalls that lead to liability claims and higher errors and omissions (or professional liability) insurance costs.

Before purchasing errors and omissions insurance (E&O), consider factors such as premium pricing, insurance company ratings, and policy limits.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors and consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for errors and omissions insurance and other policies from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Hear from customers like you who purchased E&O coverage.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance.