How much does professional liability insurance cost?

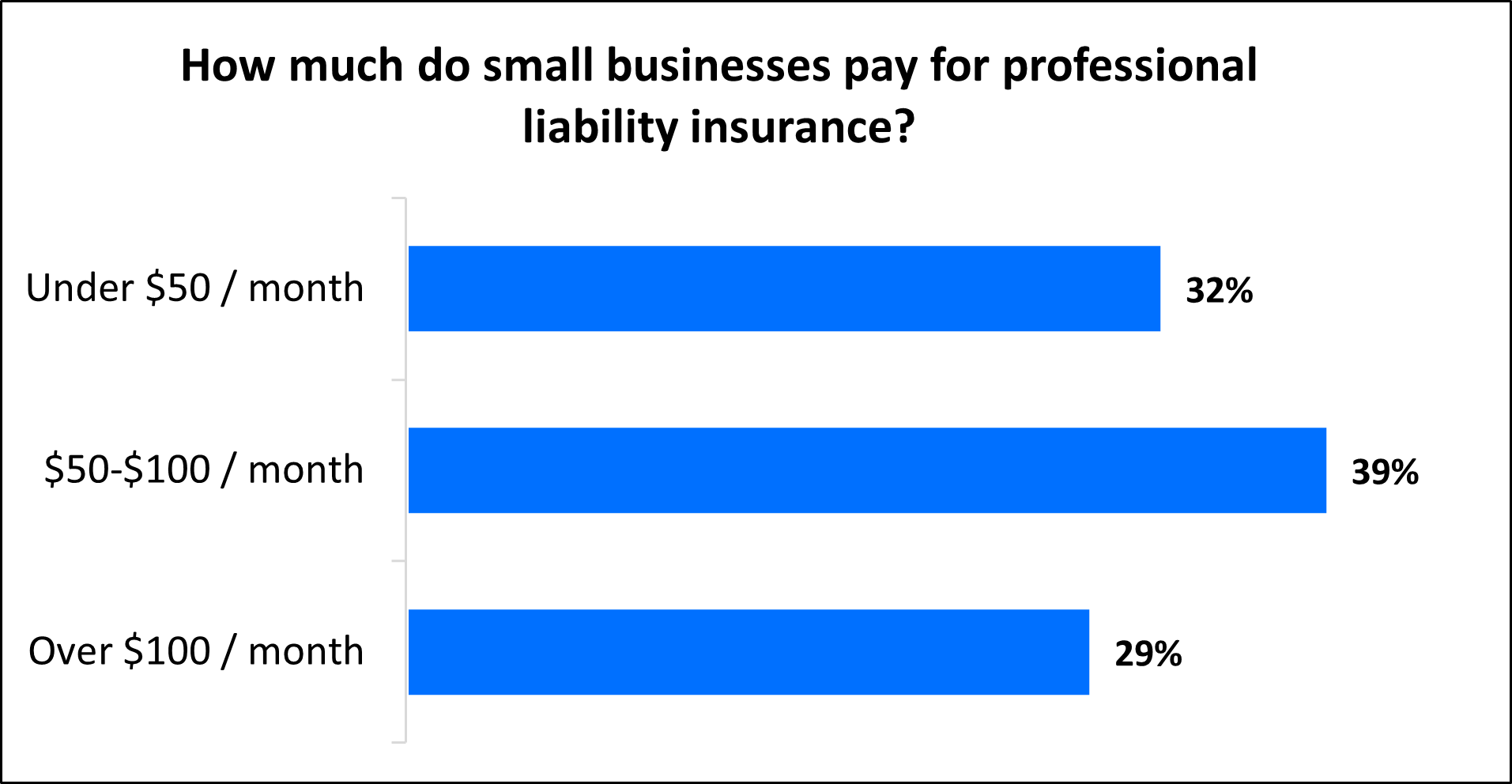

The average premium cost for professional liability insurance (also called errors and omissions insurance) is about $60 per month. Your industry and the scope of your services affect the exact cost of this policy.

What is the average cost of professional liability insurance?

Regardless of insurance policy limits, the average cost of professional liability insurance for a small business is $61 per month (or about $735 annually). Most policyholders can expect to pay a premium between $50-$100 per month for their professional liability insurance coverage.

These estimates were derived from an analysis of the median cost of thousands of insurance policies purchased by TechInsurance's small business customers from leading business insurance companies. The median cost offers a more accurate estimate of what your business is likely to pay than the average cost of business insurance because it excludes outlier high and low premiums.

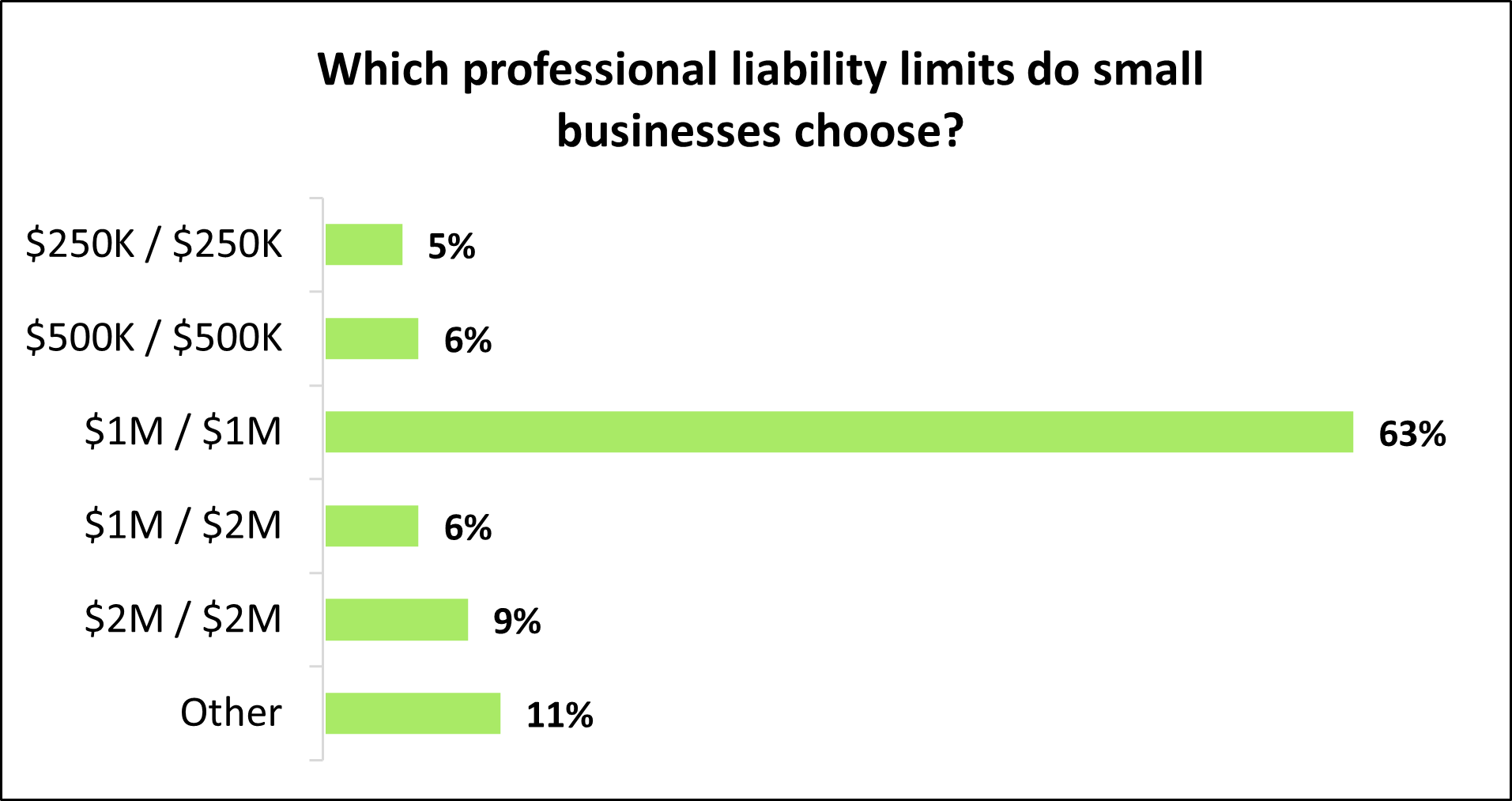

Policy limits determine the cost of professional liability insurance

The limits on professional liability policies vary significantly, from $250,000 to $2 million. Most TechInsurance customers (63%) purchase a $1 million / $1 million professional liability policy.

This includes:

- $1 million per-occurrence limit. While the policy is active, the insurer will pay up to $1 million to cover any single claim

- $1 million aggregate limit. During the policy period (usually one year), the insurer will pay up to $1 million to cover all claims

If you want a professional liability insurance policy that pays out more per incident or per year, you’ll need to increase your amount of coverage – which means you’ll pay a higher premium to your insurance company.

How does your industry impact the cost of professional liability insurance?

Your type of business and the industry you work in have a significant impact on the cost of professional liability insurance, also known as malpractice insurance.

This is because different professionals are exposed to different liabilities. On average, higher risk industries pay higher premiums, while low-risk industries enjoy lower rates.

For example, a project manager whose project is expected to increase company revenue will likely pay a higher premium for their professional liability insurance policy. So might a cybersecurity professional responsible for another company’s data security.

Other factors that impact professional liability insurance costs

Your business industry and coverage limits are just a couple factors that will influence the cost of your professional liability coverage.

Your insurance provider will also look at:

Your deductible

Policies with high deductibles cost less, but you’ll have to pay that amount before you can collect on a claim. Most TechInsurance customers choose a deductible of $2,500 for professional liability coverage.

Your cyber risks

If your business deals with sensitive data, such as credit card numbers or phone numbers, it's a good idea to get cyber liability insurance.

You can bundle your professional liability insurance, also called errors and omissions insurance, with cyber coverage in a package called technology errors and omissions insurance.

Tech E&O insurance costs depend on the amount of data and the number of employees who can access it. It’s simple math: more people accessing more data increases the chance of a data breach.

For example, large IT consulting businesses with sensitive digital assets would pay more for their tech E&O policy than a smaller technology company with fewer employees.

Your claims history

Insurance companies look at your claims history to determine how risky you are to insure. Small businesses that have made prior professional liability claims will pay more for insurance than those with a clean history.

Number of employees

It's simple: The more employees you have, the more opportunities there are for a client to file a lawsuit.

While professional liability insurance is recommended for many small businesses, most state laws require small business owners to carry workers' compensation if they have employees, and commercial auto insurance if they have business-owned vehicles.

Even if you are a freelancer, independent contractor or sole proprietor, it's still a good idea to carry professional liability coverage to protect yourself from the high costs associated with legal defense costs.

How can you save money on professional liability coverage?

There are several things you can do to keep your professional liability insurance costs low.

Some strategies include:

Pay your entire premium upfront

You can choose to pay your insurance premiums once a month or once a year. While making a smaller payment each month requires less money up front, it may cost more in the long run since insurers often offer discounts to businesses that pay an annual premium.

Keep continuous coverage

While it’s possible to purchase professional liability coverage when you start a project and drop coverage when you complete the project, this cost-cutting strategy can backfire.

To collect insurance benefits, your “claims-made” professional liability policy must be active:

- When an alleged mistake occurs

- When the claim is filed

Continuous coverage is key if you don't want to pay out-of-pocket for professional liability lawsuits.

Choose a higher deductible

Choosing a higher deductible is an easy way to save on your premium, but make sure to choose a deductible you can still afford. If you can’t pay your premium, you won't be able to collect on a claim.

Bundle policies

Some small businesses may be eligible to bundle cyber liability insurance with their professional liability coverage in a technology errors and omissions policy. Generally, this policy costs less than purchasing the coverages separately.

Reduce your risks

Small businesses with no previous claims on their insurance can expect to pay less for business insurance.

You can avoid claims with a risk management plan for professional liability exposure and cybersecurity threats. This includes:

- Open communication with clients to avoid oversights

- Client approval of every step of a project

- A formal procedure for resolving complaints

- Strict protocols for handling customer data

- Use of firewalls and other security technology to reduce cyber risks

- Educating clients on how to prevent data breaches

If your business offers expert advice or provides professional services, you should strongly consider professional liability insurance to protect your company from costly lawsuits. Here’s why you may need this coverage, when it’s required, and how it can safeguard your business.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors and consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for professional liability insurance and other policies from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Hear from customers like you who purchased professional liability coverage.

Learn more about business insurance costs

Insurance premiums vary based on the policies a business buys. See our small business insurance cost overview or find out the average costs for other common types of coverages.