How much does general liability insurance cost?

Commercial general liability insurance is usually the first policy that small businesses buy. It protects you from the legal costs of common accidents, and is very affordable for most small businesses.

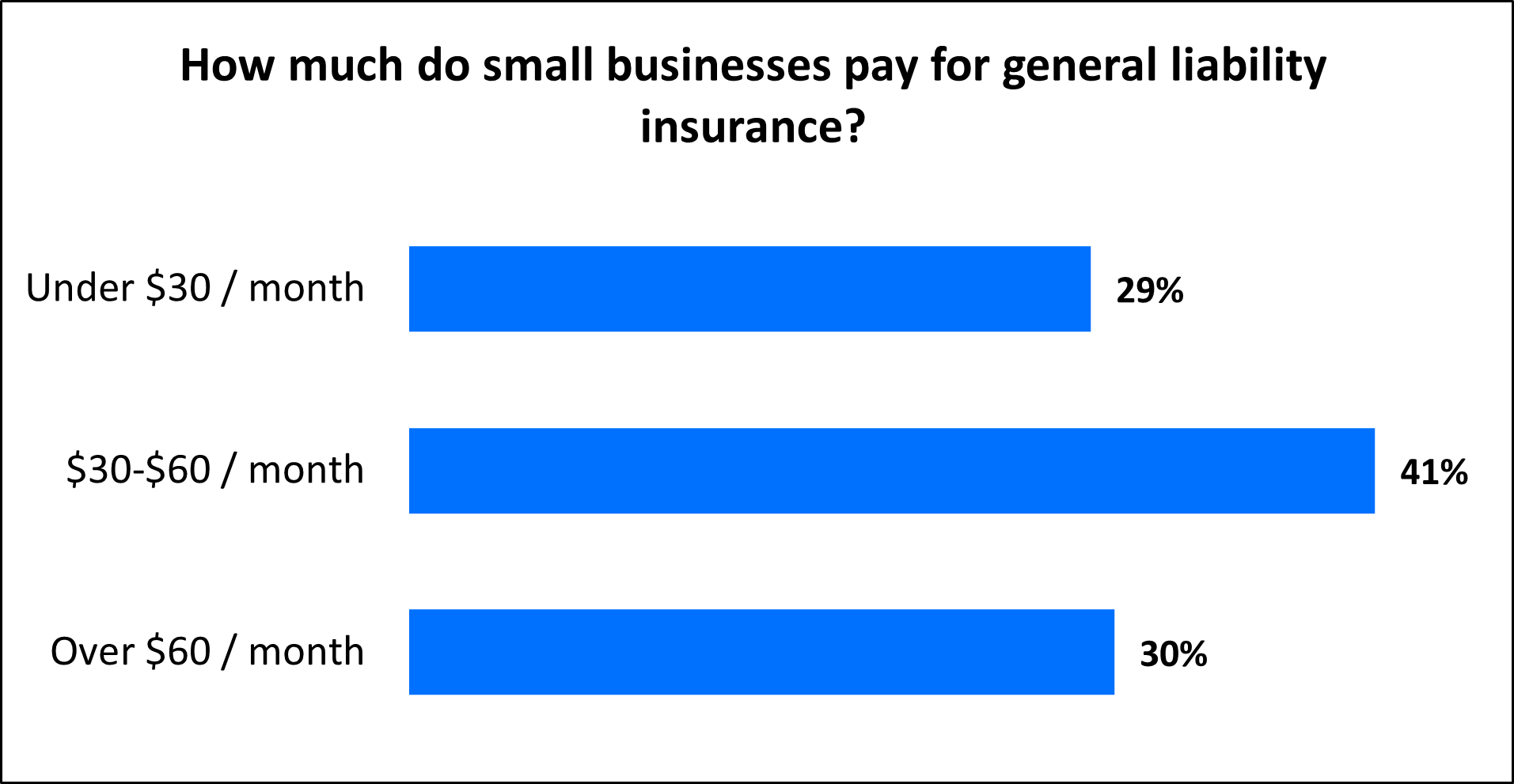

What do small businesses pay for general liability insurance?

On average, general liability insurance costs $42 per month, or about $500 annually. Most policyholders can expect to pay a premium between $30 and $60 per month for their general liability insurance coverage.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Policy limits determine the cost of general liability insurance

The cost you pay for general liability insurance depends on your coverage limits. Most small business owners opt for a general liability policy with a $1 million per-occurrence limit and a $2 million aggregate limit.

General liability insurance covers most third-party risks. Companies with a storefront or frequent client interaction should consider higher policy limits as they’re more susceptible to bodily injury, property damage, and advertising injury lawsuits. Higher limits cost more, but they cover more expensive claims.

Other factors that affect commercial general liability insurance costs

The more you work with the public the more you’ll pay for this policy. When determining your premium, your insurance company will look at:

Business location and operations

Your business operations and location can have a huge impact on the premium you pay. For example, businesses that are situated in areas of higher crime rates or increased foot traffic may have to pay higher premiums than those located in areas where these factors are lower.

For example, a busy IT staffing agency with people constantly coming and going will pay more for this policy than a web designer’s office that only sees a few clients a month.

While general liability insurance is recommended for all small businesses, most state laws require small business owners to carry workers' compensation insurance if they have employees, and commercial auto insurance if they have business-owned vehicles.

Which small business insurance policies does your state require?

Your industry

Your industry is another factor that will impact the cost of your general liability insurance rates. Generally, high-risk industries will have to pay more for their premiums compared to low-risk industries.

For example, businesses in industries with a reputation for filing more claims, such as computer repair or other work involving other people’s property, will likely pay more for business liability insurance.

Your deductible

Policies with high deductibles cost less, but you’ll have to pay that amount before you can collect on a claim. Most TechInsurance customers choose a deductible of $500 for general liability insurance.

Your claims history

Insurance companies look at your claims history to determine how risky you are to insure. Companies that have made commercial general liability claims will pay more for insurance than those with a clean history.

Number of employees

It's simple: The more employees you have, the more opportunities there are for an accident to occur or a client to file a lawsuit.

Even if you are a freelancer, independent contractor or sole proprietor, it's a good idea to carry general liability coverage to protect yourself from the high costs associated with legal defense and/or medical expenses.

How can you reduce the cost of general liability insurance?

Get the most out of your policy by considering the following:

- Purchase a business owner’s policy (BOP). Small low-risk businesses may be eligible for a business owner’s policy. A BOP bundles a general liability insurance policy with commercial property insurance and costs less than purchasing the policies separately.

- Pay the annual premium. When you buy a policy, you can choose to pay your premium monthly or annually. The annual amount costs less than paying by the month.

- Manage your risks. Claims make your premium go up – so reduce your risks to avoid claims and keep your premium low.

How can you avoid making claims on your general liability policy?

To reduce the chance of a liability claim on general liability coverage:

- Mop up spills promptly to prevent slip-and-fall accidents

- Tape down loose cables

- Create a protocol for social media posts

- Install security cameras to monitor accidents

- Be careful about using images, music, and other intellectual property to avoid copyright infringement claims

Though you can’t eliminate every risk, these steps help avoid conflicts that lead to third-party lawsuits.

Many factors determine which general liability insurance policy is the right one for your business. Here’s how to choose a policy by looking at six different aspects of your general liability insurance quotes.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including contractors and consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for general liability insurance and other policies from top-rated U.S. carriers. TechInsurance insurance agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Hear from customers like you who purchased general liability coverage.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out how much you can expect to pay for common types of business insurance.