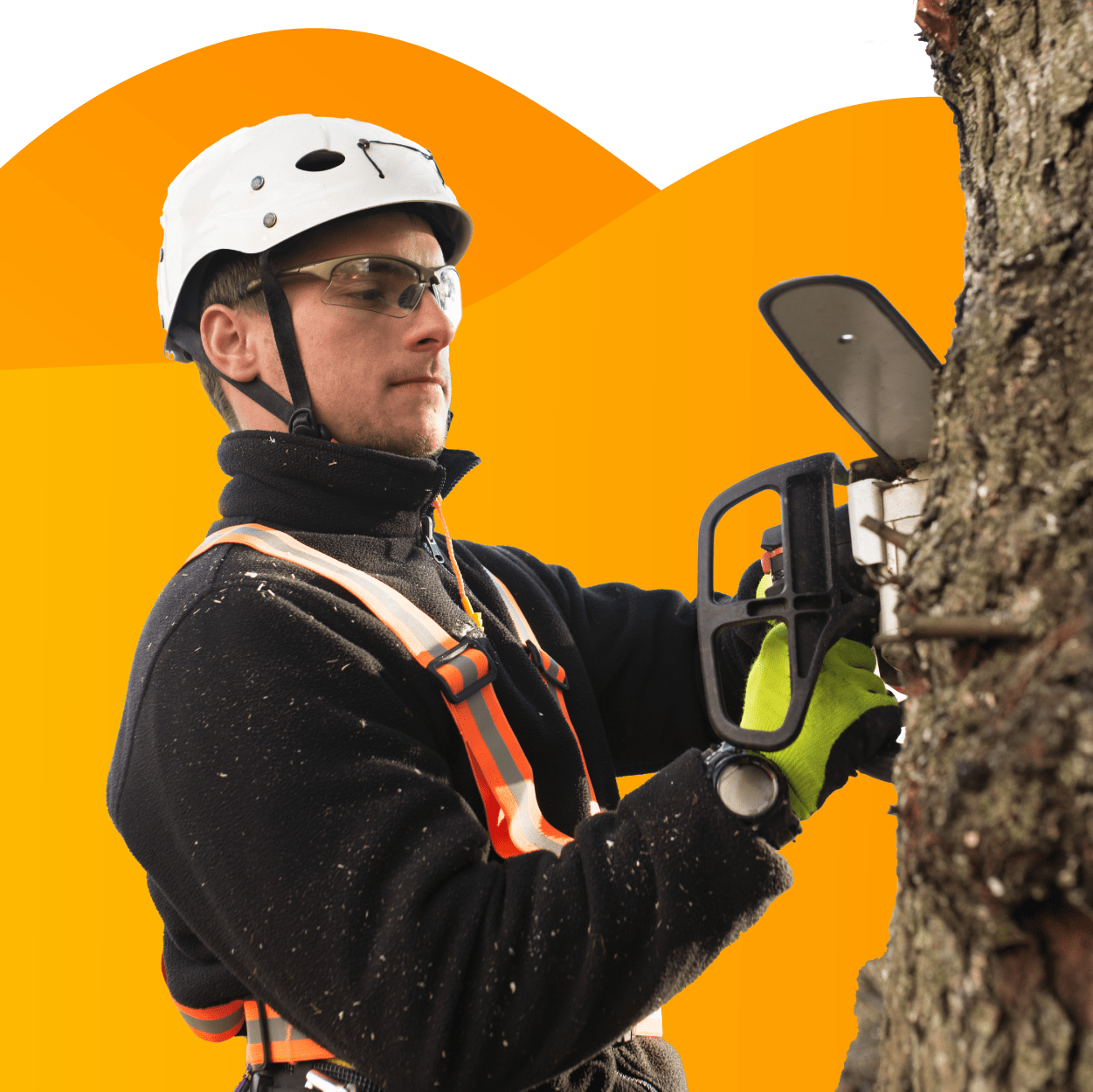

Why is insurance a must for tree trimming businesses?

Tree service businesses face several risks and liabilities. Should a tree branch fall and injure a homeowner or down a power line, a lawsuit could follow. Tree trimming insurance can safeguard your tree business from legal and financial burdens due to injuries, property damage, theft, and vehicle accidents.

Get the right insurance

6 insurance policies every tree company should consider

These small business insurance policies protect against the most common risks for tree service companies.

General liability insurance

A general liability policy protects tree care professionals against legal fees from third-party property damage and injuries. It's often required for a commercial lease.

- Slip-and-fall injuries

- Accidental damage to a client's property

- Libel and other advertising injuries

Business owner's policy

Small business owners and contractors are usually eligible for a business owner's policy, or BOP. It bundles general liability coverage and commercial property insurance at a discount.

- Client bodily injuries

- Damaged customer property

- Stolen or damaged business property

Workers' comp insurance

Most states require businesses with employees to carry workers' compensation insurance. Personal health insurance won’t cover work-related injuries, which makes this policy crucial for sole proprietors too.

- Work-related medical bills

- Disability benefits

- Lawsuits from workplace accidents

Commercial auto insurance

Vehicles owned by a tree service business must have a commercial auto policy to comply with state laws. It helps pay for financial losses in an accident, including medical expenses and property repairs.

- Injuries caused by your tree trimming vehicle

- Property damage caused by your truck

- Vehicle theft or vandalism

Contractor's tools and equipment

A type of inland marine insurance, this business equipment coverage protects tree service tools and equipment wherever you bring them. That includes items in transit, stored off-site, or used at a job site.

- Newer tools and equipment

- Items valued at under $10,000

- Tools that travel to clients' properties

Cyber insurance

This policy helps tree trimmers survive data breaches and cyberattacks. It pays for customer notification costs when credit card numbers or other personal information is exposed.

- Data breach investigations

- Customer notification costs

- Fraud monitoring services

Tree service insurance cost

From our customer data, here's a quick look at average tree care business insurance costs:

General liability: $138 per month

Business owner's policy: $181 per month

Workers' compensation: $186 per month

Factors that can influence tree service business owners' premiums include:

- Your tree maintenance services offered

- Number of employees

- Value of your tree trimming tools and equipment

- Types of insurance purchased

- Policy limits, deductibles, and additional insureds

- Claims history

Hear from business owners like you who purchased insurance coverage.

Why tree removal businesses choose TechInsurance

Get insured quickly with TechInsurance

Get insurance fast so you can get started working with clients. Fill out our easy online application, choose a policy, and pay online to start coverage today.

Common questions about tree service insurance

Take a look at answers to frequently asked questions (FAQs) about tree maintenance and removal insurance.

Are tree removal businesses required to be licensed and insured?

Most tree removal and service businesses need to be licensed, however the exact licensing requirements will vary by state. In most cases, you'll likely need a few key elements beyond licensure under your belt in order to operate. This could include education, industry experience, business registration, certifications, permits, bonds, and insurance.

There are two types of licenses you might be required to obtain: an arborist license and a contractor's license.

Additionally, the International Society of Arboriculture (ISA) and the Tree Care Industry Association (TCIA) provide accredited certifications, which might be a requirement for some contracts or municipalities.

Some examples of state license requirements are:

- Minnesota: Most Minnesota cities require tree trimming professionals to be licensed in their city of operations before they can offer their services. Some municipalities require tree contractors to be ISA-certified arborists to work on public property and trees.

- California: In order to obtain a tree service license in California, which is required to perform any tree trimming or removal services, you must complete four years of journeyman experience and pass the Contractor State License Board exam.

- Maine: For tree removal and trimming in Maine, you must be a licensed arborist. To do so, you need to pass the Maine arborist licensing exam and show proof of general liability of at least $150,000 per occurrence and $300,000 aggregate.

What other types of tree removal insurance coverage do I need?

For a comprehensive risk management plan, tree service professionals, LLCs, and independent contractors may need additional types of insurance, beyond general liability coverage and workers' compensation coverage.

Some additional tree service insurance policies to consider are:

- Hired and non-owned auto insurance (HNOA): Tree service businesses who drive their own pickup or other vehicle to clients' properties should invest in this insurance, as your personal auto insurance won't cover business use. HNOA provides auto liability coverage for personal, leased, and rented vehicles used by your business.

- Commercial property insurance: Homeowner's insurance provides little to no protection for business property, which is why you may need commercial property insurance. It protects against financial losses from fires, storms, and burglaries.

- Inland marine insurance: Because commercial property insurance only covers items at your main business location, you'll likely need additional coverage for tools and equipment that travel to job sites. Contractor's tools and equipment insurance is one example of this coverage, which can protect your tree cutting business's chain saws, pole saws, stump grinders, and other tree maintenance equipment.

- Commercial umbrella insurance: An umbrella policy boosts the protection of your general liability, commercial auto, and employer's liability insurance, activating when the limit is reached on the underlying policy.

- Business interruption insurance: Also called business income insurance, this policy covers lost revenue and other expenses should a covered event, like a fire, temporarily close your business. It can usually be added to your commercial property policy.