How much does landscaping business insurance cost?

The cost of landscaping business insurance depends on the type of policies and amount of coverage you choose. Insurers will also look at your landscaping services, business revenue, and claims history. Save money on small business insurance by comparing quotes from different carriers with TechInsurance.

Key insurance policies and their expected costs for landscaping businesses

Here are the top small business insurance policies bought by landscaping companies and contractors and their average monthly costs:

- General liability insurance: $51 per month

- Business owner's policy: $94 per month

- Commercial auto insurance: $204 per month

- Workers' compensation insurance: $169 per month

- Contractor's tools and equipment insurance: $38 per month

- Cyber insurance: $145 per month

- License/permit bonds: $9 per month

- Commercial umbrella insurance: $88 per month

Our figures are sourced from the median cost of policies for landscaping businesses that apply for quotes with TechInsurance. The median provides a better estimate of your expected insurance costs because it excludes outlier high and low premiums.

General liability insurance costs for landscaping businesses

Landscaping businesses and contractors spend an average of $51 per month, or $610 per year, for general liability insurance.

Lawn care professionals, landscape designers, tree trimmers, and other professional landscapers may need this coverage in order to sign a commercial lease, get licensed, or work with certain clients.

General liability insurance covers legal costs when a third party (someone outside your company) files a lawsuit over property damage or a bodily injury. It also pays for advertising injuries, such as libel, slander, and copyright infringement.

Working on a client's property opens your business to liabilities. A customer might trip over your landscaping equipment, like a rake, or a worker may damage a client's outdoor décor. If they file a lawsuit, a general liability policy would help pay for your legal costs.

This is the average general liability insurance policy for landscaping businesses that buy from TechInsurance:

Premium: $51 per month

Policy limits: $1 million per occurrence; $2 million aggregate

Deductible: $500 per month

The cost of general liability insurance depends on several factors, including the policy limits and deductible you choose. Insurance providers will also consider your type of business, the size of your business, and any subcontractors or additional insured endorsements you may have.

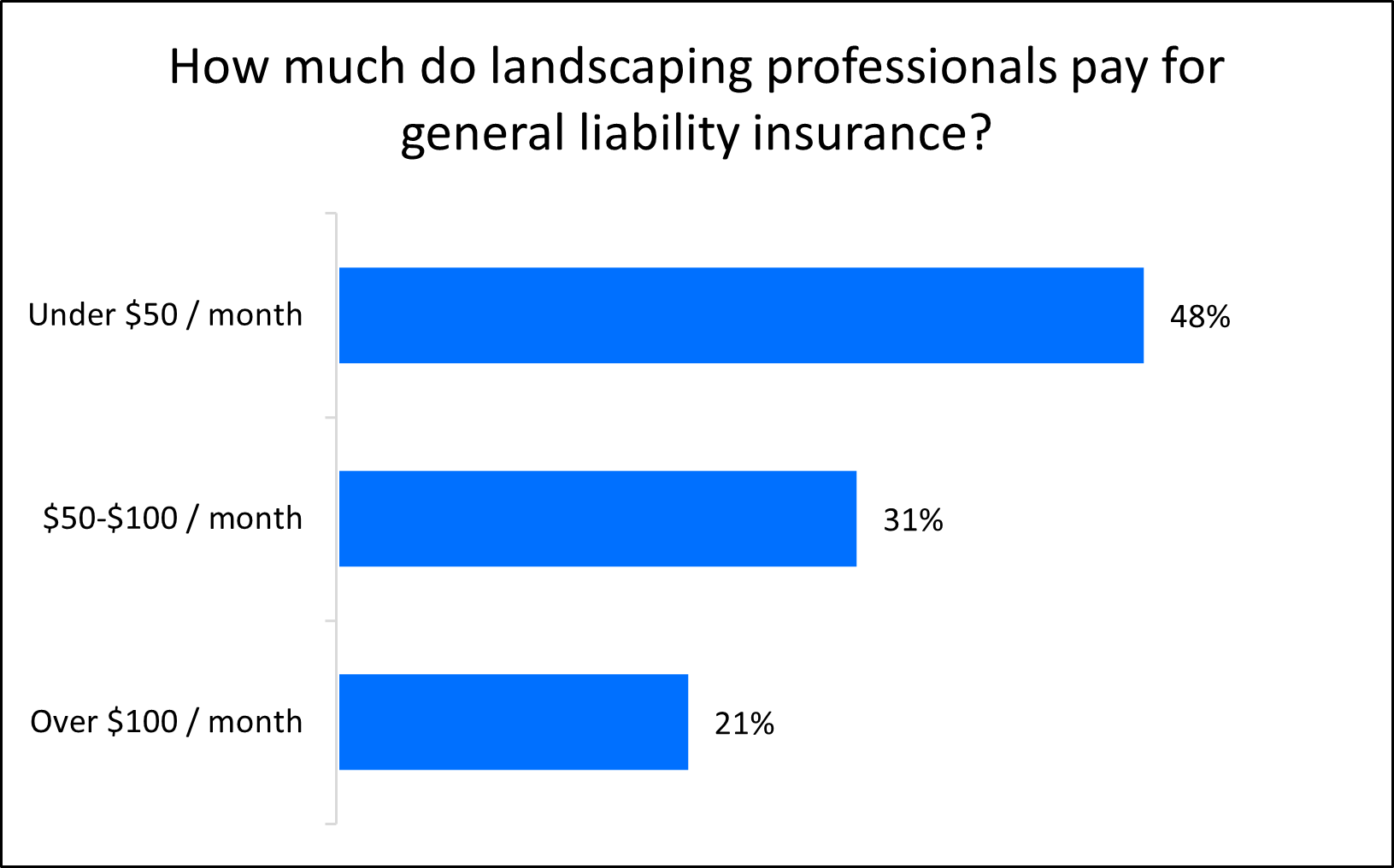

General liability insurance costs can be affordable for landscaping businesses

Fortunately, limited liability companies (LLCs) and other small landscaping businesses don't have to pay a lot for insurance. Among landscaping companies that buy with TechInsurance, 48% pay less than $50 per month for general liability insurance. Another 31% pay between $50 and $100 per month.

Factors such as your business revenue, size, and location affect your insurance costs. By choosing lower coverage limits or a higher deductible, you can reduce your premium to an amount that fits your landscaping company's budget.

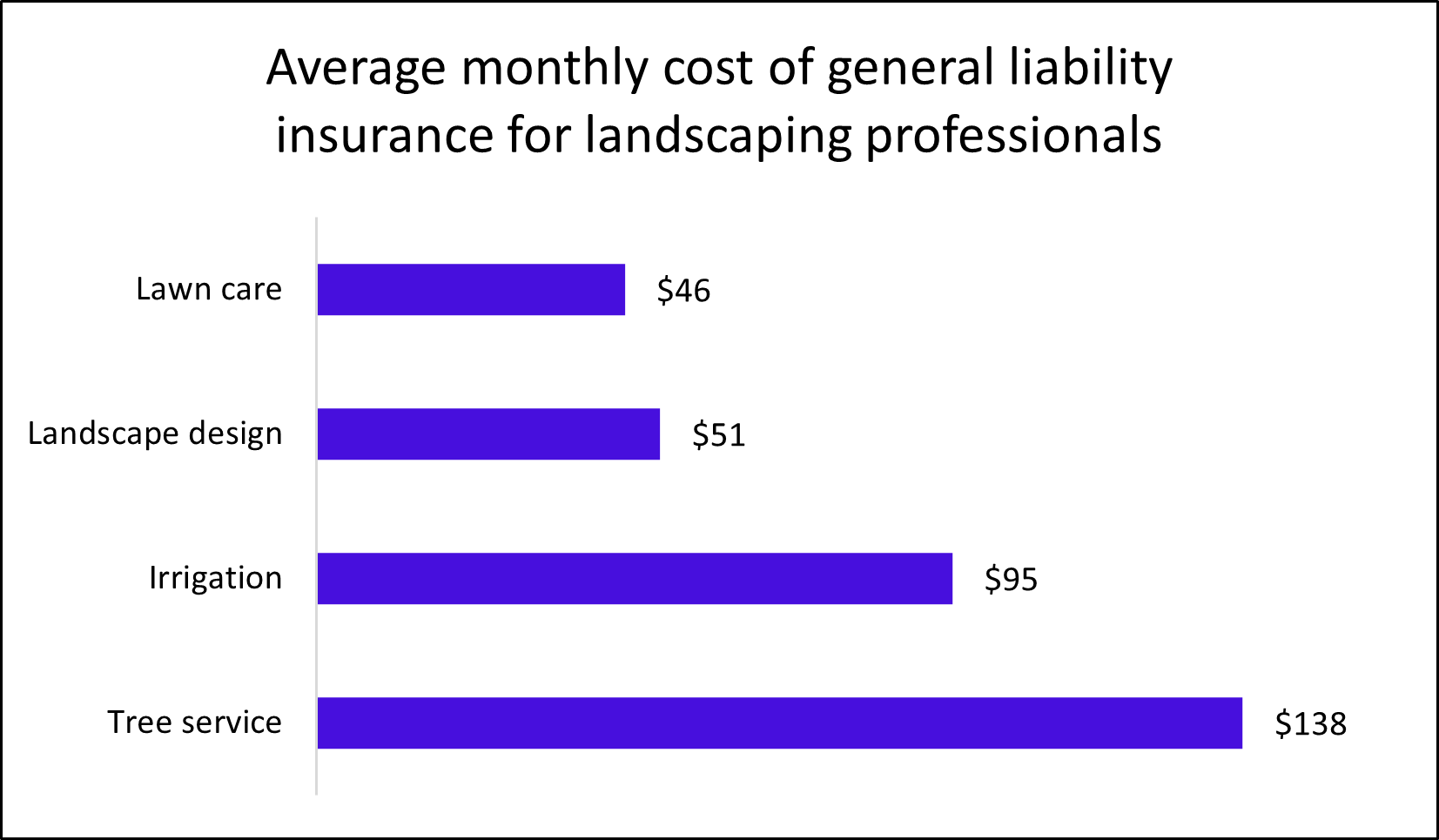

Your profession affects the cost of general liability insurance

The risks of your specific profession, such as tree service or landscape design, are a major factor when determining your insurance costs.

That might include:

- The size and location of your office premise

- Specific types of landscaping services you provide

- The kind of customer property you work on (residential, commercial, etc.)

- The claims history of others in your profession

To some extent, you can predict how much you'll pay for insurance by looking at costs for similar businesses. On average, lawn care businesses pay a lower rate of $46 per month for general liability insurance, while tree service companies pay a higher rate of $138 per month.

Below, you can see how much different landscaping professions pay for general liability coverage.

Business owner’s policy costs for landscaping businesses

Small, low-risk landscaping businesses may be eligible for a business owner’s policy (BOP), which costs an average of $94 per month or $1,130 annually.

A business owner's policy bundles general liability coverage with commercial property insurance at a lower rate than buying these policies separately. It protects against the most common liability and property lawsuits and helps your business recover from a fire, burglary, or other property loss.

You can add business interruption insurance to a BOP to defend against the cost of a temporary shutdown tied to a covered property claim. For example, it would help pay for employee wages and the cost of renting an office while your landscaping business is closed for renovation after a fire.

The cost of a business owner's policy mostly depends on the value of your business property. Other factors, such as your business's size and location, can also affect your premium.

Commercial auto insurance for landscaping businesses

Landscaping businesses spend an average of $204 per month, or $2,452 per year, for commercial auto insurance.

Most states require this coverage for vehicles owned by a landscaping business. If you get into an accident, it can help pay for medical expenses, property repairs, and legal fees. It also covers vehicle theft and vandalism, in case your truck or other lawn care company vehicle is stolen or damaged.

Keep in mind that sole proprietors and independent contractors who drive their own vehicle for work will need extra coverage as well. Your personal auto policy won't cover work-related accidents, so you'll want to consider buying hired and non-owned auto insurance (HNOA).

HNOA provides liability coverage for personal, leased, and rented vehicles driven for work purposes.

Insurance companies consider many factors when determining the cost of a commercial auto policy. That includes your employees' driving records, policy limits and deductibles, the number of vehicles you own and their value, and the coverage options you choose.

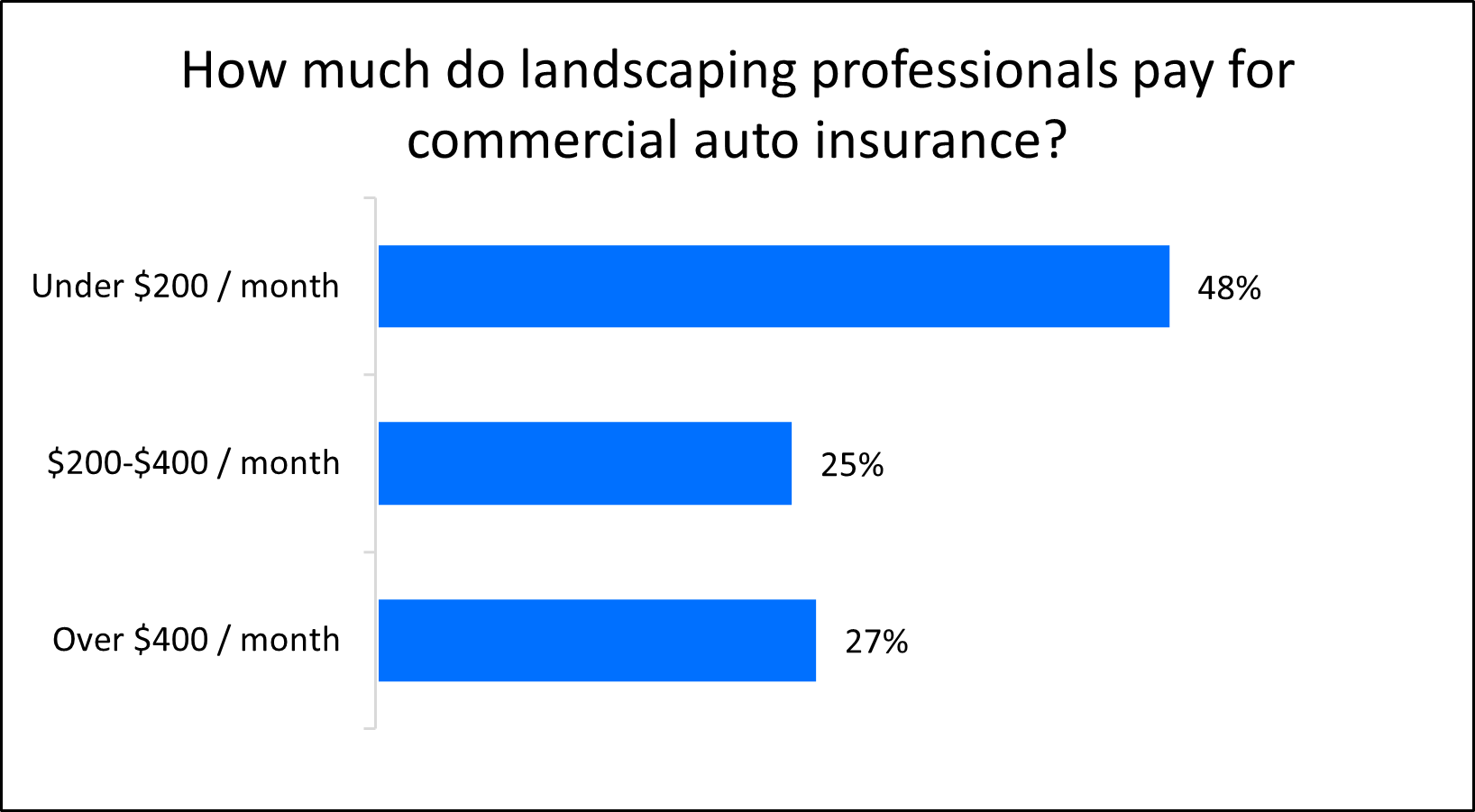

The types of landscaping vehicles you use and their value determine commercial auto costs

The types of company-owned vehicles you have, their value, and how often you use them all impact your commercial auto insurance costs. Landscapers who have vehicles of high value and use them often can expect to pay more for coverage than those who have low-value vehicles and use them seldom.

Among TechInsurance customers, 48% of landscaping companies and contractors pay less than $200 per month for commercial auto insurance. And another 25% pay between $200 and $400 per month for coverage.

Additional factors that influence your commercial car insurance costs include the number of company vehicles you have, employees' driving records, and your claims history.

Workers' compensation insurance costs for landscaping businesses

On average, landscaping business owners pay $169 per month for workers' compensation insurance, or $2,029 annually.

State laws determine when you need workers' comp. In most states, you need it as soon as you hire your first employee. Only Texas and South Dakota do not have requirements for workers' comp, but it's still recommended.

Workers' compensation coverage pays for medical expenses and provides disability benefits if you or an employee suffers an injury on the job, or develops an occupational disease.

For example, if a tree service worker falls off a ladder while trimming a tree and breaks their leg, this policy would pay for their ambulance ride, medical appointments, and other medical costs. It also supplies part of the income they miss out on while they are recovering and unable to work.

Most workers' compensation policies include employer's liability insurance. This type of insurance helps pay for legal defense costs related to workplace injuries.

Though sole proprietors and independent contractors aren't often required to carry workers' comp, it's still a good idea to buy this coverage. If you're injured on the job, your health insurance plan will likely deny the claim, leaving you with hefty out-of-pocket medical bills.

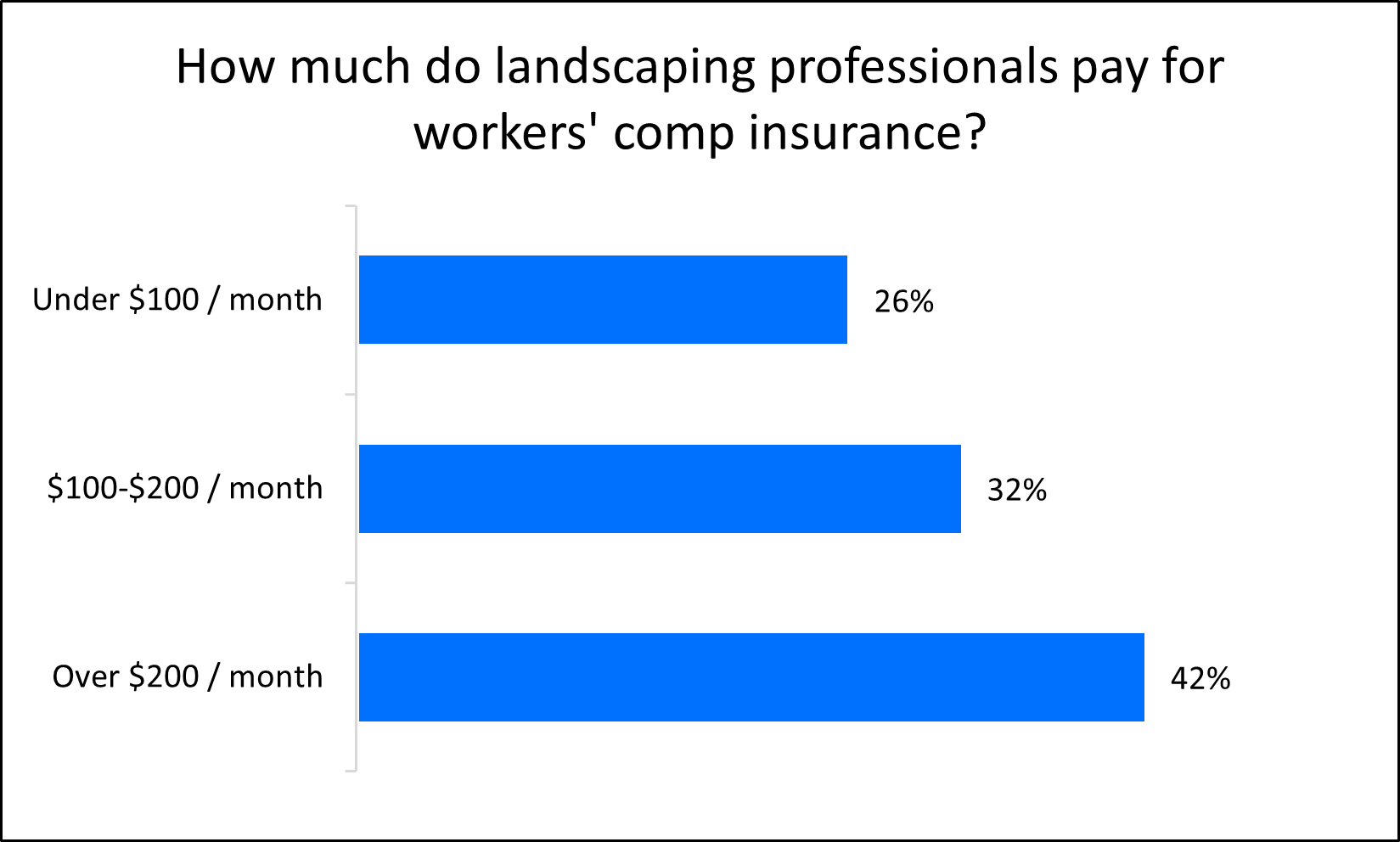

The cost of workers' comp depends on occupational risks

The chance of an on-the-job injury is the biggest factor in determining workers' compensation insurance premiums. Landscaping professions that have a higher risk of injury should expect to pay more.

As you can see, 26% of landscaping businesses pay less than $100 per month for workers' compensation insurance. And 58% pay $200 or less per month for insurance coverage.

Insurance companies will take into account the number of employees you have, their occupational risks, and your claims history when calculating the cost of workers' comp.

Contractor’s tools and equipment insurance for landscaping businesses

Landscaping contractors pay an average of $38 per month, or $450 yearly, for contractor's tools and equipment insurance.

It's important to know that commercial property insurance only covers your main business location and its contents. If you bring items to jobsites or store them off-site, you'll need inland marine insurance for protection against fires, theft, and other property losses.

Contractor's tools and equipment insurance is a type of inland marine insurance. Specifically, it covers movable items that are valued at under $10,000 and less than five years old. That includes leaf blowers, lawn mowers, pesticides, trimmers, shovels, wheelbarrows, and similar items.

As with the cost of commercial property insurance, the cost of contractor's tools and equipment insurance mostly depends on how much the items are worth.

Cyber insurance for landscaping businesses

Small businesses spend an average of $145 per month, or $1,740 annually, for cyber insurance. Also known as cyber liability insurance or cybersecurity insurance, this policy helps pay for the cost of complying with your state's data breach laws.

A cyber insurance policy can cover expenses related to a data breach or cyberattack, including legal fees and customer notification costs. It is especially crucial for landscaping companies that store personal customer information, such as credit card numbers or phone numbers.

The cost of cyber insurance primarily depends on the amount of sensitive information handled by your landscaping business.

License/permit bonds for landscaping businesses

License and permit bonds are two kinds of surety bonds. Among TechInsurance landscaping customers, the average cost of a surety bond is $9 per month, or about $112 annually.

A surety bond guarantees that your landscaping business will fulfill the terms of a contract. This might include finishing a project by a deadline, complying with regulations, or paying subcontractors and other involved parties fairly for their work.

If your business fails to meet the terms of the contract, the surety company will compensate your client for their financial loss. Unlike a business insurance policy, this money must be paid back to the company that issued the bond.

As with a fidelity bond, the cost of a surety bond is a percentage of the total bond amount.

Commercial umbrella insurance for landscaping businesses

Landscaping contractors and businesses pay an average of $88 per month, or $1,060 annually, for commercial umbrella insurance.

Commercial umbrella insurance boosts the coverage of your underlying policies, such as:

- General liability insurance

- Commercial auto insurance

- Employer's liability insurance

For example, if a multi-vehicle crash results in costs that exceed the limits on your commercial auto insurance, then umbrella insurance would kick in to provide coverage, up to the limit of the umbrella policy.

This coverage is similar to excess liability insurance, which can increase limits on a single policy, such as general liability insurance. You might need an umbrella policy to sign a commercial landscaping contract or to get coverage for the most expensive types of lawsuits.

Umbrella insurance is available in $1 million increments. The cost of an umbrella policy depends on how much coverage you buy, along with other factors.

How do I get affordable landscaping business insurance with TechInsurance?

Lawn care, landscape design, tree service, and other landscaping professionals can find affordable business insurance and bonding in three easy steps with TechInsurance:

- Fill out a free online insurance application with details about your business.

- Compare custom business insurance quotes from top-rated U.S. providers in real-time.

- Choose the best policies for your business and pay the premiums to begin coverage.

TechInsurance's licensed insurance agents are available to help answer questions about state insurance requirements, the best types of coverage for your business needs, and landscaping insurance costs based on your budget.

Once you've bought a policy, you can download a certificate of insurance for peace of mind and proof of insurance. Small business owners usually get insured within 24 hours of applying for quotes.