How much does product liability insurance cost?

Product liability insurance helps pay for lawsuits related to defective products. It's typically included in general liability insurance, which costs an average of $42 per month for TechInsurance's customers.

What do small businesses pay for product liability insurance?

If you want to buy product liability insurance, the easiest way is to buy a general liability insurance policy, which usually includes this coverage. Together, the policies provide coverage for legal costs from bodily injuries, property damage, and wrongful death caused by your business—or its products.

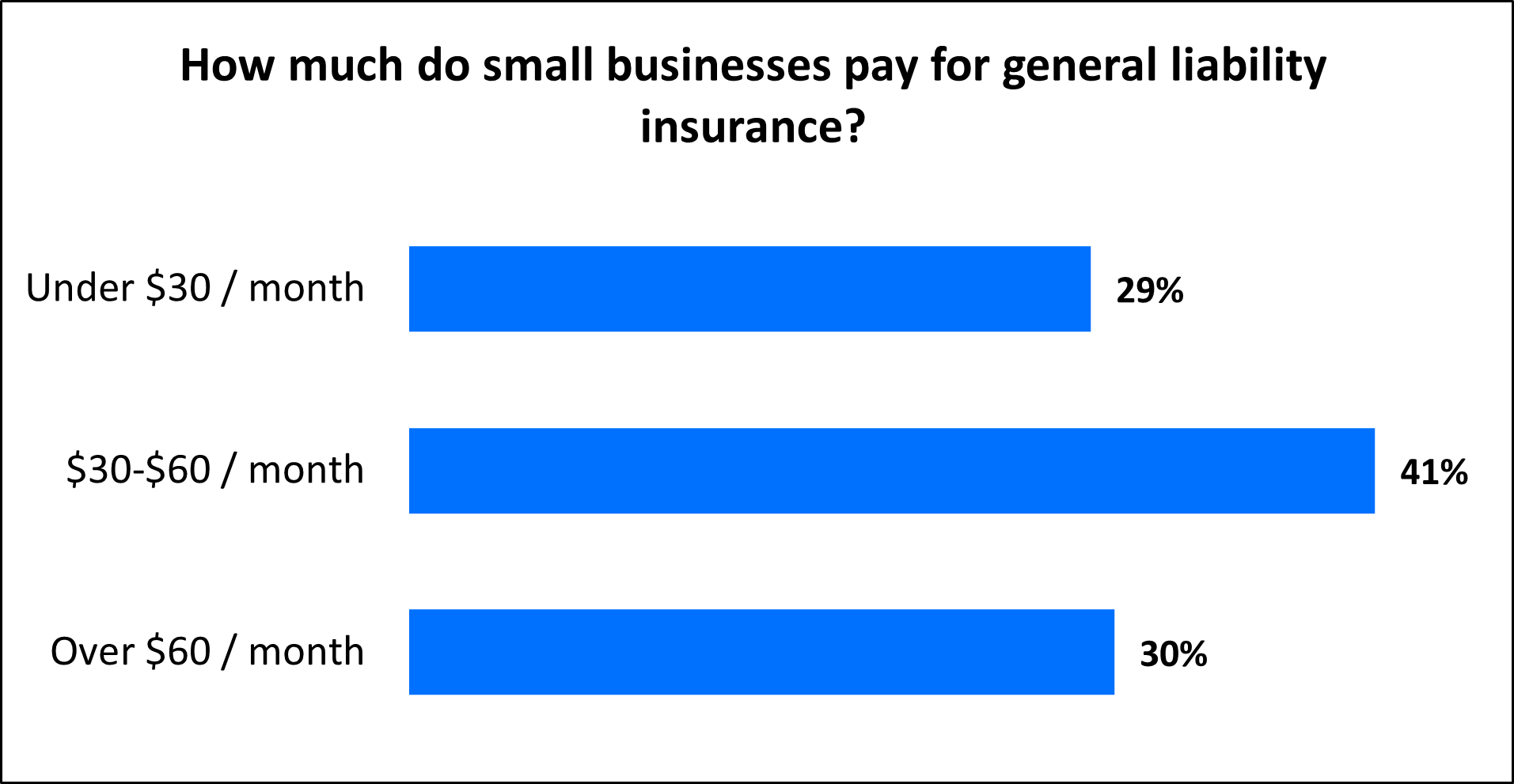

The average cost of general liability insurance is $42 per month, or $500 annually. The majority of small businesses (70%) pay $60 per month or less for their policies.

Our figures are sourced from the median cost of business insurance policies purchased by TechInsurance customers from leading insurance providers. The median provides a better estimate of what you're likely to pay because it excludes outlier high and low premiums.

How are product liability insurance costs calculated?

Because it's bundled with general liability insurance, the cost of product liability coverage depends on the same factors. That includes your industry, business revenue, and location.

The specific risks of the products you sell, distribute, or manufacture will also affect your premium. For example, an e-commerce store that sells car seats or booster seats could be considered at high risk of a product liability lawsuit and have to pay more for this coverage.

The same is true for other businesses where a product defect could result in significant medical expenses. That includes food and healthcare businesses, where a product might cause an allergic reaction or other harmful effect.

Retailers, distributors, wholesalers, manufacturers, and importers should all carry a product liability insurance policy. Any business in the supply chain can be sued for a defective product. Product liability insurance also covers strict liability, or instances where your business was not at fault.

Here's a closer look at the factors that affect how much you'll pay for this type of insurance:

Policy limits determine the cost of product liability insurance

Perhaps the most important factor is the amount of coverage you buy, or your policy limits. Product liability insurance has two limits:

- The per-occurrence limit is the maximum amount that your insurance company will pay for claims related to a single incident.

- The aggregate limit is the most the insurer will pay for claims during the policy period, which is typically one year.

Your product liability coverage limits are often, but not always, the same as your general liability limits. Most small business owners (91%) choose a general liability policy with a $1 million per-occurrence limit and a $2 million aggregate limit.

Businesses that could end up facing expensive product liability lawsuits should opt for higher limits to avoid paying costly legal fees out of pocket. A policy with higher limits costs more, but it will cover more expensive insurance claims.

Other factors that affect product liability insurance costs

Insurance companies will consider the following factors when determining your premium:

- Your industry. To determine your level of risk, providers will look at the claims history of businesses in similar professions to yours.

- Business revenue. In general, businesses that earn more have a higher rate of accidents and claims, which makes them costlier to insure.

- Your location. A business in a high-crime area, or even an area with a high level of foot traffic, can expect to pay more for liability insurance.

- Deductible. A policy with a higher deductible costs less, but you'll need to pay that amount before you can benefit from having insurance coverage.

- Types of products. Businesses that handle higher risk products, such as ones associated with significant medical costs or legal defense costs, will cost more to insure.

- Claims history. If you've faced a claim over a faulty product in the past, then this will cause your insurance premium to go up.

Am I able to separately purchase product liability insurance coverage?

Businesses don't often need to buy product liability insurance as a standalone policy—as opposed to part of their general liability policy—but it does happen.

For example, some carriers might offer standalone product liability policies that include product recall insurance. This coverage helps pay for restocking costs and other financial losses associated with the recall of a defective product.

When determining the cost of a standalone policy, insurers will take into consideration many of the same risks, including your location, revenue, and industry. They will also look at the types of claims you might face, such as legal costs related to design defects, manufacturing defects, and marketing defects.

How can you reduce the cost of product liability insurance coverage?

General liability insurance is already one of the most affordable policies, but there are a few ways to lower your premium.

First, it's important to shop around. Insurance companies sell the same types of coverage at different rates. With TechInsurance, you can fill out an online application to easily compare product liability insurance quotes from the nation's leading carriers.

Here are a few other ways to save money on product liability insurance:

- Buy a business owner’s policy (BOP). Small low-risk businesses may be eligible for a business owner’s policy. A BOP bundles general liability coverage with commercial property insurance at a discount, and typically includes product liability insurance.

- Pay the annual premium. Insurance companies let you pay your premium in monthly or annual installments. Paying the full annual amount will cost less in the long run.

- Reduce your risks. Avoiding product liability claims helps keep your premium low. Thoroughly test your products, enact a strict quality control (QC) process to avoid defects, and work only with trusted suppliers.

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, from contractors to consultants, with extensive knowledge of the IT sector. We help business owners compare quotes from top-rated providers, buy policies, and manage coverage online.

By completing TechInsurance's easy online application today, you can compare free quotes for general liability insurance and other policies from top-rated U.S. carriers. Our licensed agents are available to help answer any questions you may have.

Once you find the right policies for your small business, you can begin coverage in less than 24 hours and get a certificate of insurance for your small business.

Hear from customers like you who purchased general liability coverage.

Learn more about other business insurance costs

Insurance premiums vary based on the policies a business buys. View our small business insurance cost overview or find out how much you can expect to pay for common types of business insurance.