How much does liquor liability insurance cost?

The average premium for liquor liability insurance is $45 per month. Your coverage limits and alcohol sales affect the exact cost of this policy, among other factors.

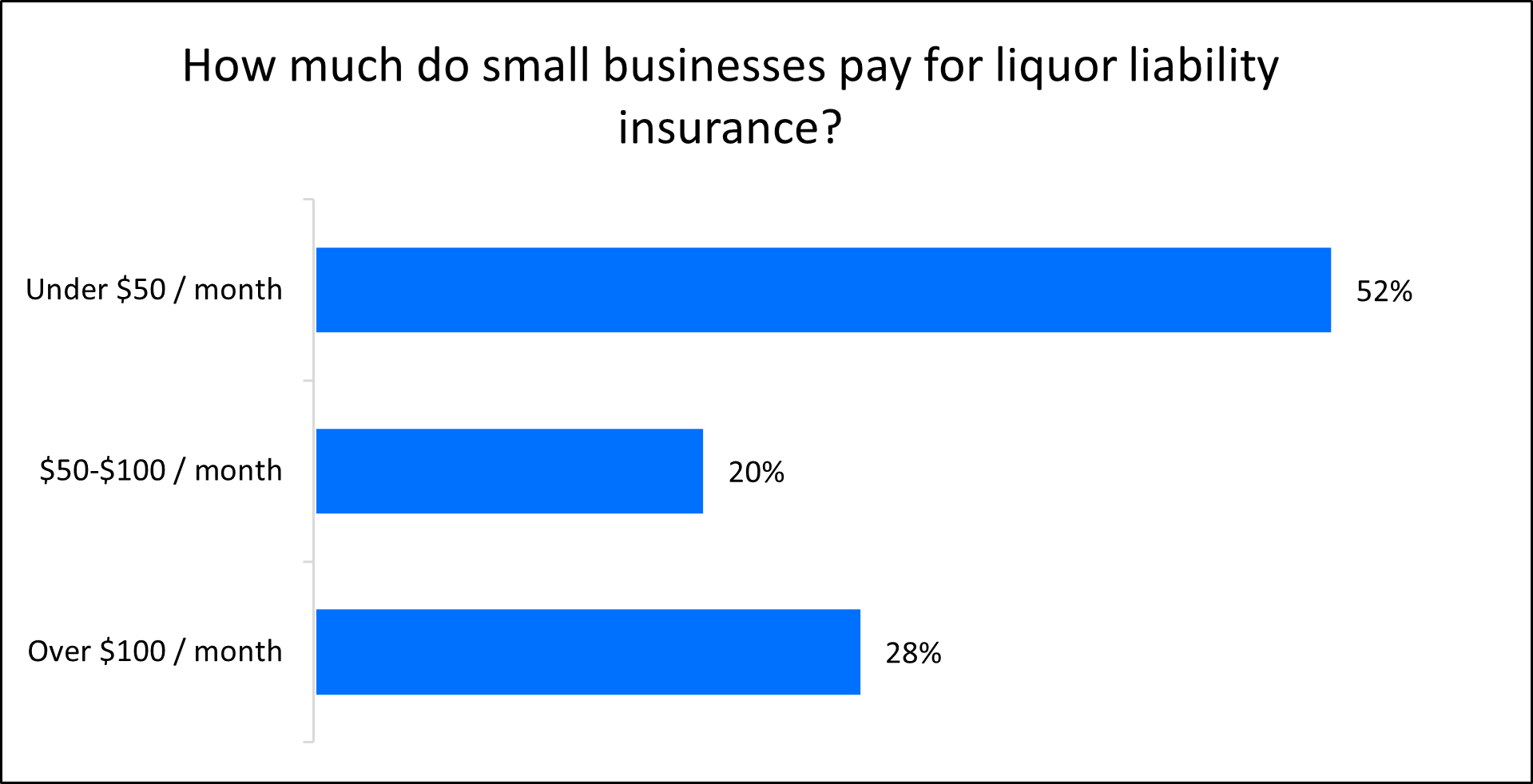

What do small businesses pay for liquor liability insurance?

On average, liquor liability insurance costs $45 per month, or about $542 annually. Over half (52%) of our policyholders pay less than $50 per month for their liquor liability coverage.

Our figures are sourced from the median cost of policies purchased by TechInsurance customers from leading business insurance companies. The median provides a better estimate of what your business is likely to pay because it excludes outlier high and low premiums.

Policy limits determine the cost of liquor liability insurance

The amount you pay for liquor liability insurance depends on your coverage limits. Higher limits are more expensive, but they offer more coverage.

Restaurant owners usually opt for a liquor liability policy with a $1 million limit, while bar businesses tend to choose a $2 million limit.

Liquor liability insurance covers legal fees, settlements, and medical bills up to the policy limits, if alcohol is sold to an intoxicated individual who then harms another patron physically or damages their property. It's also known as dram shop insurance.

Any small business that sells or serves alcohol is usually required to have this coverage in order to obtain a liquor license. This includes liquor stores, taverns, fast food restaurants, grocery stores, and convenience stores.

Get general liability coverage for complete protection

For full protection and complete peace of mind, you should also get general liability insurance. A general liability insurance policy protects your business from common third-party risks, such as customer bodily injury and property damage.

It often includes host liquor liability insurance, which helps cover legal costs and medical expenses if an intoxicated individual at a business-hosted special event causes physical harm or property damage.

Learn more about other recommended insurance coverages for retailers and food and beverage companies.

Key professions that need liquor liability coverage

Other factors that affect liquor liability insurance costs

Your policy limit is just one factor that determines your liquor liability insurance costs.

Let's take a closer look at how other factors may affect the cost of your policy:

How does your deductible influence costs?

The deductible you select will affect the cost of your liquor liability insurance policy. The higher your deductible is, the less you have to pay for your premium.

Choosing a higher deductible is an easy way to save on your premium, but make sure to choose a deductible you can still afford. If you can’t pay your deductible, you won't be able to collect on an alcohol-related claim.

How do your liquor sales impact costs?

The percentage of your alcohol sales directly impact your liquor liability insurance costs. Small businesses with a higher percentage of alcohol sales usually have more expensive premiums.

For this reason, bars should expect to pay more for their liquor liability coverage than a restaurant or other businesses that also sell food.

How does your location affect costs?

Depending on where you live, some state laws mandate a certain amount of liquor liability coverage if you sell or serve alcoholic beverages on your premises.

For instance, South Carolina businesses that serve alcohol after 5 p.m. must have a liquor liability policy with a minimum $1 million limit. It's not uncommon for some states to increase their coverage limit requirements on a yearly basis.

Below are average liquor liability insurance costs across different states among TechInsurance customers:

- South Carolina: $18

- Florida: $34

- Oregon: $34

- California: $39

- Texas: $58

- Colorado: $66

- North Carolina: $71

- Georgia: $88

- Tennessee: $91

- New Jersey: $131

How does your claims history determine costs?

Insurance companies look at your claims history to determine how risky you are to insure. Companies that have made liquor liability claims will pay more for insurance than those with a clean history.

How can you reduce the cost of liquor liability insurance coverage?

There are several things you can do to keep your liquor liability insurance costs low.

Some strategies include:

Bundling policies

Small low-risk businesses may be eligible for a business owner’s policy (BOP). A BOP bundles general liability coverage with commercial property insurance and costs less than purchasing the policies separately. You can often add liquor liability insurance coverage to your BOP as an endorsement.

If you're not eligible for a BOP, you can also add liquor liability coverage as an endorsement to your general liability policy.

Paying the annual premium

You can choose to pay your insurance premiums once a month or once a year. While making a smaller payment each month requires less money up front, it may cost more in the long run since insurers often offer discounts to businesses that pay an annual premium.

Managing your risks

Companies with no previous claims on their insurance can expect to pay less for business insurance. Small business owners can help keep their claims history clean with a risk management plan.

This could include:

- Training your bartenders and caterers on important aspects of alcohol service, such as dram shop laws and how to handle an intoxicated patron who wants to engage in drunk driving

- Rolling out discounted food options that can help balance your customers' alcohol consumption

- Offering water at no cost alongside alcoholic drinks to reduce the occurrence of intoxicated customers

- Eliminating hazards on your premises

Liability claims can be a threat to your business. If you’re accused of injuring someone, damaging property, or causing other harm it could easily turn into a costly lawsuit. That’s why it's important to have the right insurance protection in place to cover a range of potential liability risks.

How do you buy insurance with TechInsurance?

TechInsurance is a trusted insurance expert for small businesses, including startups and independent contractors, with extensive knowledge of the IT sector. We help small business owners compare quotes from top-rated insurance carriers, buy the right type of insurance policies based on their business needs, and manage coverage online.

By completing TechInsurance's easy online application today, you can get free quotes for liquor liability insurance and any additional coverage. Our insurance agents are available to help answer any questions you may have on your coverage options.

Once you find the right policies for your small business, you can begin your insurance coverage in less than 24 hours and get a certificate of insurance for your small business.

Learn more about business insurance costs

Insurance premiums vary based on the types of policies a business buys. View our small business insurance cost overview or find out the average costs for other common types of business insurance policies.